Disabled Adult Child Benefits Guide

By Kenton Koszdin Law Office on December 10, 2023 | In Social Security Disability

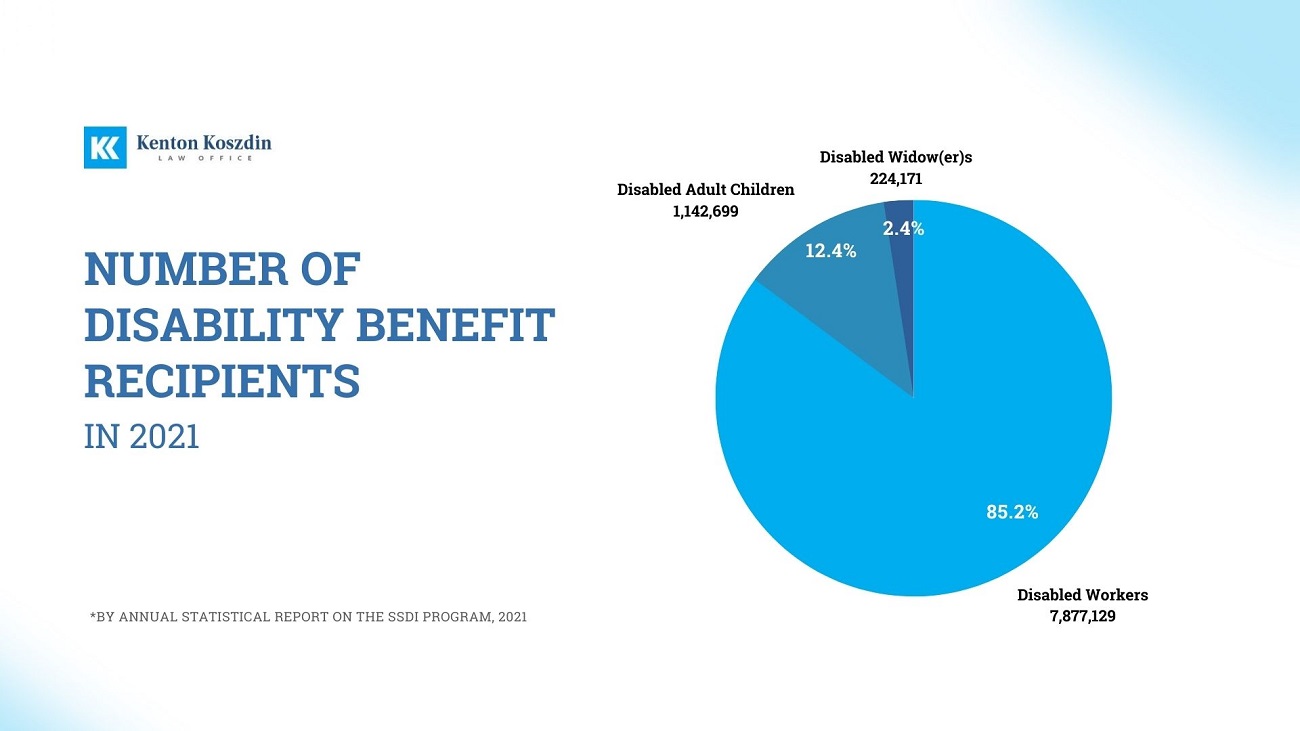

Social Security Disability Insurance (SSDI) benefits are not limited to injured workers. Disabled adults may also qualify through their parents’ benefits.

Specifically, disabled individuals over 18 could get SSDI benefits as a disabled adult child (DAC), even if they don’t meet the disability program’s own earnings requirements. This lesser-known option provides income support if your child has a disability and is unable to work.

The disability attorneys at Kenton Koszdin Law Office explain how it works. We cover the application process, eligibility rules, and the benefits provided through Social Security if approved as a disabled adult dependent. This could be an overlooked source of assistance for younger disabled adults in financial need.

What Is the Adult Child Disability Program?

The Disabled Adult Child benefits program is a part of Social Security Disability Insurance and is administered by the Social Security Administration. It provides financial support to adults who developed disabilities before age 22 and remain dependent on their parents.

Benefits are available to qualifying adult children of retired, disabled, or deceased parents who were eligible for SSDI benefits. The benefit amount is based on the parent’s earnings record. Importantly, it does not reduce the parent’s own Social Security benefits.

What Benefits Can I Receive as a Disabled Adult?

Disabled adults may qualify for multiple types of benefits based on their family situations and their needs:

DAC Benefits Through Social Security Disability Insurance (SSDI)

To qualify for SSDI as a disabled adult child, the individual must have a disability that began before age 22 and be unmarried. In order for the disabled adult child to be eligible, their parent must be deceased or receiving Social Security retirement or disability benefits.

The disabled adult child must prove they have a qualifying disability that prevents them from being able to work substantially. If approved for DAC benefits, they can receive a monthly payment based on the parent’s earnings record. Their parent will continue to receive their own Social Security payments.

Adult Disability Benefits Through Supplemental Security Income (SSI)

SSI is based on financial need rather than work credits. To be eligible, the disabled adult must prove they have a qualifying disability. They must also show that their family’s household income and resources fall below a certain threshold. Some income can be excluded.

In addition to meeting the income limits, U.S. citizenship or qualifying immigration status is required.

If approved for SSI, the recipient will receive a monthly payment to help supplement any income. The benefit amount depends on what other income they receive. In many cases, SSI can provide assistance if SSDI criteria are not met.

What Are the Requirements for DAC Benefits?

An adult disabled child must meet these key requirements to receive Social Security disability benefits through the DAC program:

- Unmarried: The disabled adult child must be unmarried.

- Age: The DAC must be age 18 or older.

- Onset: The disability must have begun before the child was 22 years old.

- Relationship: The disabled adult child must be the biological child, adopted child, stepchild, or dependent grandchild of a retired, disabled, or deceased wage earner who worked long enough to qualify for Social Security.

- Disability: The DAC must meet Social Security’s strict definition of disability: Their impairment must prevent them from working and must be expected to last at least one year or result in death.

- Substantial Gainful Activity (SGA): The disabled adult child cannot earn more than the SGA limit, which is $1,470 per month for 2023 and $1,550 for 2024.

The adult child’s disabled claim goes through a five-step sequential evaluation process to determine medical eligibility. This involves assessing work activity, severity of impairment, meeting disability listings, ability to do past work, and ability to do other work.

SSI vs. SSDI vs. DAC Benefits: What Is the Difference?

The differences between SSI, SSDI, and DAC benefits are not always clear. Here is a short explanation:

SSI

Supplemental Security Income (SSI) is a monthly needs-based payment for disabled adults and children who have limited income and assets. Unlike SSDI benefits, someone applying for SSI is not required to have paid into Social Security. The payments for SSI are usually lower than for SSDI benefits.

SSDI

Social Security Disability Insurance (SSDI) benefits are for disabled workers who have worked and paid Social Security taxes long enough to be insured for benefits. SSDI is not needs-based.

DAC Benefits

The Disabled Adult Child (DAC) benefits program provides SSDI benefits for adults who developed disabilities before age 22 and who have a parent who receives Social Security retirement or disability benefits.

What Happens If DAC Recipients Get Married?

If a disabled adult child receiving Social Security benefits gets married, they will likely lose their DAC benefit and Medicare coverage. Even if the marriage ends in divorce or widowhood, the DAC benefit is permanently terminated unless limited exceptions apply.

One exception is when a DAC beneficiary marries another Social Security beneficiary. Another exception occurs when a DAC beneficiary’s marriage ends due to divorce or widowhood, in which case the DAC can become re-entitled to benefits if their other parent retires, dies, or becomes disabled.

Therefore, a DAC recipient cannot marry a working spouse without losing their federal benefits. The DAC program was created to provide for disabled adult children when their parents can no longer support them due to disability, retirement, or death. Therefore, the benefit ends if another worker (the DAC’s spouse) can provide for them instead.

Is It Possible for a Child Already on SSI Benefits to Continue Receiving Them?

An adult child with a disability has the ability to receive both SSI and DAC benefits, and they may also be eligible for Medicare. If the SSI benefit surpasses the DAC benefit, which is based on a parent’s employment history, the SSA will provide the higher amount.

When a child who is already receiving SSI benefits turns 18, they can continue to receive SSI disability benefits. The Social Security Administration will review their condition and follow adult disability rules to determine whether they are eligible.

A child who continues to receive SSI benefits after turning 18 will find the process for applying for DAC benefits smoother when their parents retire, become disabled, or pass away. Since the SSA has already determined that the DAC beneficiary’s disability began at age 18 or before, this is inherently proof of disability prior to the age of 22.

Is It Possible for an Employed Person to Still Qualify for Benefits?

Being employed can pose legal obstacles for individuals receiving Disability Adult Child benefits due to the stipulation that the DAC recipient must demonstrate an ongoing disability that began before age 22. However, there are several exceptions to the general principle that a DAC beneficiary cannot be gainfully employed:

- Not Substantial Gainful Activity (SGA): The pay falls under a certain income threshold.

- Unsuccessful Work Attempt: If the employment income is above the SGA level but lasts for less than six months and ceases due to the disabling impairment, the employment is considered an unsuccessful attempt.

- Not Profitable After Deducting Impairment-Related Work Expenses: The SSA will subtract impairment-related work expenses, such as costs for medical devices required to perform the job. If the income after these deductions is below the SGA level, the employment is not considered a gainful activity.

- Carried Out Under Special Conditions or Subsidized: If the DAC beneficiary is employed in a protected work environment, the SSA will assess whether they are earning the income they are being paid. For instance, some charities or government organizations offer employment and employment support for disabled adults under constant and close supervision.

Discover Your Benefits with Kenton Koszdin Law Office Lawyers

Our Social Security attorneys at Kenton Koszdin Law Office are well-versed in the complexities of DAC benefits rules and are equipped to guide you through the process. We are adept at navigating the common pitfalls of the program, ensuring that you meet all necessary deadlines, and presenting compelling evidence.

Our skills extend to preparing parents and DACs for testimony and submitting briefs regarding the applicability of SSA regulations. With our assistance, you can confidently navigate the process and put forth a strong case to receive benefits, including your child’s benefits. Trust in our professional guidance to discover and secure the benefits you are entitled to, and reach out to Kenton Koszdin Law Office today.