SSD vs. SSI: What’s the Difference?

By Kenton Koszdin Law Office on March 11, 2023 | In Social Security Disability

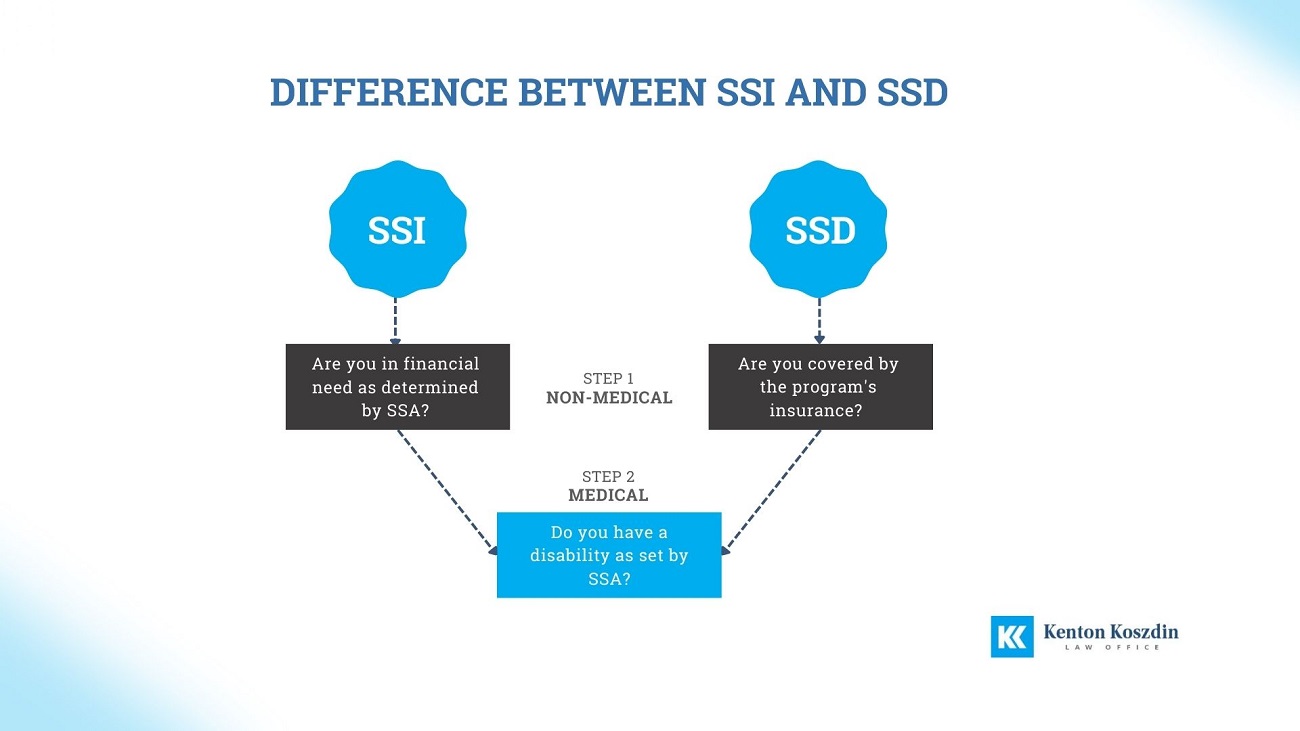

Understanding the differences between Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) can be tricky, but it’s crucial to those seeking to maximize their benefits.

Both programs offer crucial financial support to disabled individuals. However, the eligibility criteria, funding origins, and benefits display notable contrasts.

This quick comparison aims to elucidate the key parallels and distinctions between SSI and SSDI, with valuable insights from the Social Security disability attorneys at Kenton Koszdin Law Office.

What Is Supplemental Security Income (SSI)?

Supplemental Security Income (SSI)is a federal benefits program intended for individuals with limited income and financial resources, including the elderly, visually impaired, and those with disabilities, who may have little to no work history.

SSI benefits primarily go to help those who are 65 and older or disabled. Children under 18 may also qualify for SSI, albeit with differing criteria for defining a qualifying disability.

The primary distinction between SSI and SSDI lies in the work requirements. SSI benefits don’t require a work history, making them accessible to individuals with insufficient work credits for SSDI eligibility.

Eligible individuals can receive SSI and SSDI payments simultaneously in what is often referred to as a “concurrent claim.” Calculations for SSI consider an individual’s SSDI benefits as part of their financial evaluation.

Unlike SSDI or Social Security benefits, SSI recipients don’t contribute to the program. Instead, funding is drawn from the U.S. Treasury’s general fund. While some states automatically approve Medicaid benefits for SSI recipients, Virginia has its own distinct eligibility and application process for Medicaid benefits.

Given the program’s need-based nature, it’s important to note that your spouse’s income and financial resources can impact your eligibility for SSI benefits.

If your spouse is employed full-time, it may lead to reduced benefits or potential disqualification from SSI assistance. You must be aware of factors like these when navigating the intricacies of the SSI program.

What Is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance, a program funded through Social Security tax contributions, is exclusively available to individuals with an adequate work history who have contributed to the Social Security system by paying Social Security taxes.

The amount of SSDI benefits one can receive hinges on their earnings record, and eligibility is entirely independent of financial resources or income levels. To qualify for benefits, an individual must have a medical condition that impedes their ability to work and is projected to persist for at least one year or result in their demise.

Meeting the requirements for SSDI benefits entails considering both recent work and the cumulative duration of work throughout one’s lifetime. For instance, individuals aged 31 or older usually must have worked for at least five of the last 10 years to be eligible for disability benefits.

Those who become disabled between the ages of 24 and 31 must have accumulated work credits for at least half the time since they turned 21. For those who are disabled before reaching 24, a minimum of one and a half years of work within the three-year period leading up to the disability is necessary.

Gathering work credits is critical for eligibility. Individuals are allowed to earn a maximum of four work credits annually. The specific number of credits needed to reap the benefits of SSDI varies according to one’s age and increases incrementally each year.

Notably, disability benefits aren’t influenced by income or asset criteria but are solely contingent on an individual’s health status and ability to sustain gainful employment.

Similarities Between SSI and SSDI

SSI and SSDI are both designed to offer financial support to disabled individuals, and both are managed by the Social Security Administration.

The application process for each program necessitates a comprehensive examination of medical records to verify eligibility on the basis of disability. Each program also provides continuous benefits until the recipient reaches retirement age or experiences an improvement in their condition.

Differences Between SSI and SSDI

Now that you have a better idea of how SSI and SSDI are alike, here’s an overview of the main points of difference between the two programs.

| SSI | SSDI | |

|---|---|---|

| Definition of Disability | Impairment preventing employment for at least 12 months | Medical condition hindering current job with a year-long or longer disability expectation |

| Who Is It For? | Low-income, elderly, blind, or disabled individuals | Those disabled and unable to work for a year or longer |

| Eligibility Criteria | is for low-income individuals aged 65+, blind, or disabled | is for disabled individuals with sufficient work credits |

| Commencement of Benefits | begins the 1st full month after the claim is filed | has a 6-month waiting period after SSA determines disability onset |

| Maximum Monthly Benefit 2023 | $914 (individual) or $1,371 (married couple) | $3,627 |

| Health Insurance in California | recipients qualify for Medicaid | recipients qualify for Medicare after a 24-month waiting period |

| Benefit Basis | is need-based, considering income, living situation, and personal resources | is earnings-based, relying on FICA contributions |

| Documentation Required | Income, living arrangement, personal resources, and assets | Recent wage information, work and earnings history |

| Date of Eligibility | uses a protective filing date (PFD) for eligibility commencement | begins eligibility five months after the date of onset |

| Work Requirements | None; past employment doesn’t affect benefits | Varies by age, with a minimum work history required |

| Benefits Adjustment | benefits can change based on various factors | |

| Impact of Other Income | may be reduced by income from other sources | may cease if earning a substantial income |

| Assets Affecting Eligibility | has asset limits (e.g., $2,000 for individuals and $3,000 for couples) | eligibility is unaffected by assets |

SSDI vs. SSI Eligibility

Eligibility for SSI hinges on factors like age, blindness, disability, and income level, making it a needs-based program. By contrast, SSDI eligibility centers on disability and an individual’s work history.

SSI vs. SSDI Benefit Amounts

SSI and SSDI offer varying benefit amounts, with the figures evolving over time. As of 2023, the maximum monthly SSI benefit is $914 for individuals and $1,371 for couples. These amounts will increase to $943 for individuals and $1,415 for couples in 2024, as mandated by law.

SSDI, on the other hand, calculates benefits based on an individual’s earnings record. As of 2023, the average monthly SSDI payment in California is $1,395.93.

Healthcare Differences Between SSD and SSI

In most states, those receiving SSI benefits qualify for Medicaid immediately when their benefits commence. Conversely, SSDI recipients become eligible for Medicare after a 24-month waiting period from the initiation of benefits.

That said, there are exceptions for individuals with ALS or end-stage renal disease. These individuals can access Medicare without any waiting period.

Can I Receive Both SSDI and SSI?

Yes. It’s possible to receive both SSI and SSDI benefits, an arrangement that’s known as “concurrent benefits.”

This typically happens when a person qualifies for SSDI but the amount they receive is so low that they also meet the income requirements for SSI. In such cases, the individual can receive SSI payments to supplement their SSDI payments.

Get Help with Your Disability Benefits

Understanding the similarities and differences between SSI and SSDI is a must for those seeking financial assistance in the form of disability benefits.

While both programs extend crucial monetary support to individuals with disabilities, they vary significantly in terms of eligibility requirements, funding sources, and associated health insurance benefits.

If you’re unsure about your eligibility or which disability program best suits your needs, don’t hesitate to reach out to the experienced Social Security lawyers at Kenton Koszdin Law Office. Your journey to securing financial assistance through disability programs offered by the U.S. government starts here.